Category: Investing Trends

-

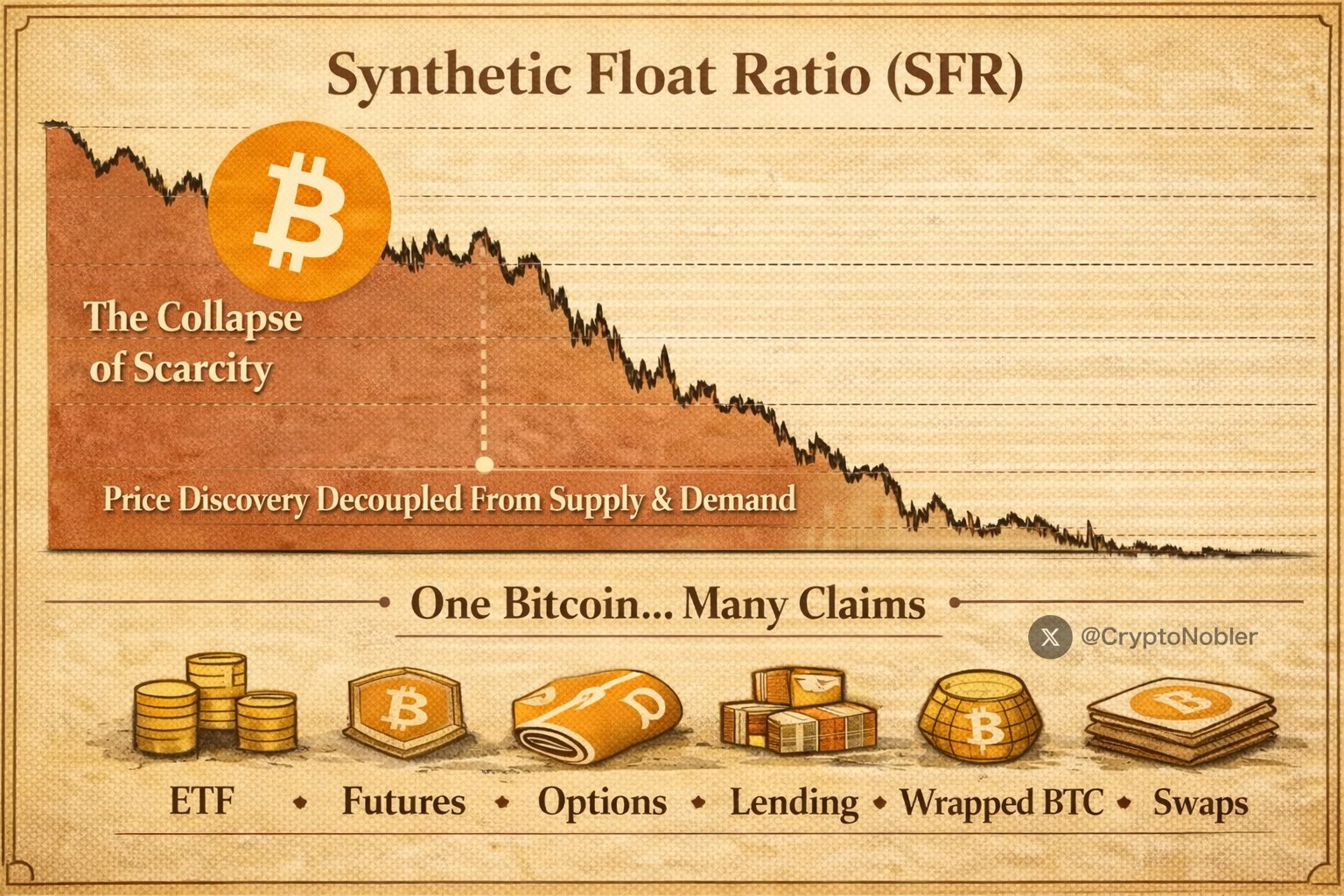

Here’s Why Bitcoin is Non-Stop Dumping Right Now

If you still think $BTC trades like a supply-and-demand asset, you MUST read this carefully. Because that market no longer exists. What you’re watching right now is not normal price action. It’s not “weak hands.” It’s not sentiment. And it’s definitely not retail selling. Most people are completely unaware what’s happening. And by the time…

-

Project Vault, a Critical Mineral Stockpile for America and the Effect on the Price of Silver

Short answer: Project Vault would likely be bullish for silver over the medium-to-long term, even if silver itself is not explicitly stockpiled. Why? Because silver sits at the intersection of strategic minerals, advanced manufacturing, electrification, and defense technology—the same ecosystem Project Vault is designed to protect. Below is how the mechanics likely translate into silver-price…

-

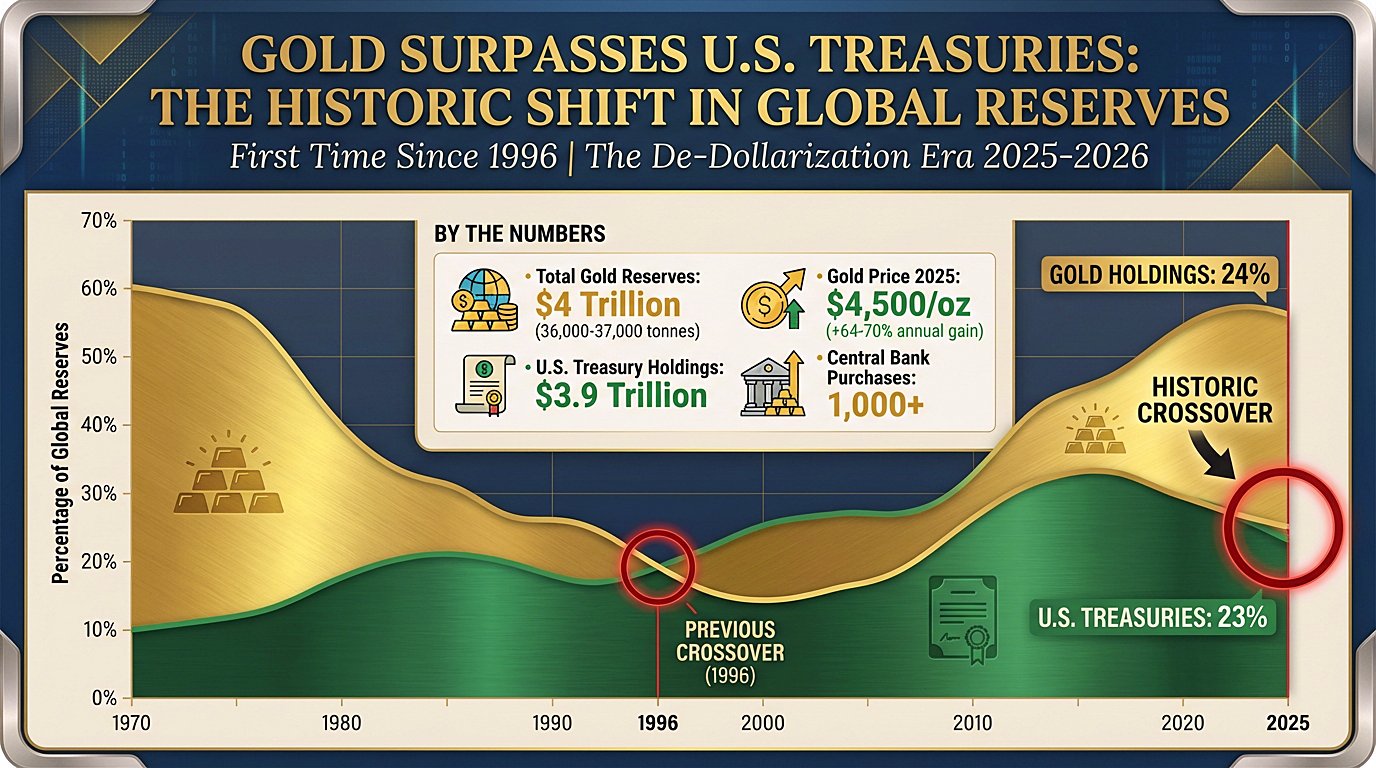

Global Gold Reserves Have Surpassed U.S. Treasury Holdings

GOLD JUST TOOK OVER THE U.S. DOLLAR FOR THE FIRST TIME IN 30 YEARS It finally happened. The data is in, and it is TERRIFYING. Especially if you live in the USA. 📈 Gold: $4T📉 U.S. Treasuries: $3.9T🏦 1,000+ central banks buying💰 $4,500/oz goldThe de-dollarization era is here. For the first time in 3 decades,…

-

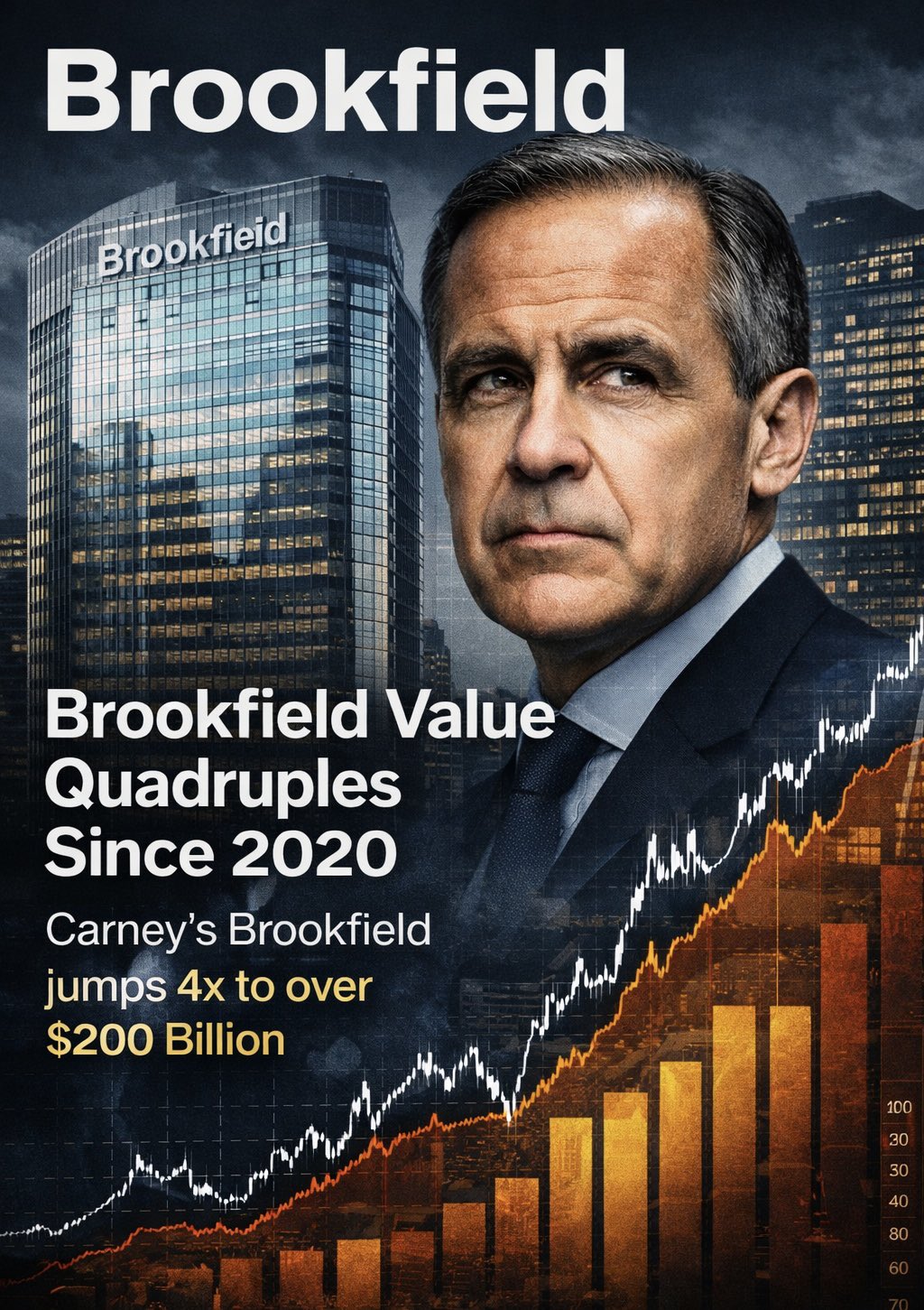

Brookfield Value Quadrupled Since 2020

Brookfield’s growth (referring to the combined Brookfield Corporation (BN) and Brookfield Asset Management (BAM) entities post-2022 restructuring) has been impressive from the 2020 lows through early 2026, particularly in fee-bearing capital and overall business scale. The original post’s claim (below) of a ~4x+ increase in combined market caps (from ~$45B in 2020 lows to ~$194B)…

-

The Two Assets That Best Meet 2026’s Global Needs

Precious Metal: Gold Why Gold remains unmatched: • Non-sovereign & non-corporate No issuer. No counterparty risk. No bankruptcy court. • 5,000+ years of universal recognition Accepted across cultures, religions, and political regimes. • Naturally scarce & energy-backed Cannot be printed, debased, or “patched.” • Neutral collateral Used by central banks precisely because it sits outside…

-

Why to Buy Precious Metals

Property values didn’t go up by 840.67%, the dollar lost that much purchasing power 95 years in 1929 the price of a troy ounce of gold was $20. There are 32.15 ozt per 1kg bar, so that equals $6,430 for 10kg of gold. Today on April 8th 2024 at 9:33PM EDT an ounce of gold…

-

Connect the Dots to the US Debt Clock

How to Spend New Money into Circulation America is the land of milk and honey, that’s the prize that attracts the best of the best. What is never told in the Hollywood version, is how hard it is and how tough you must be. The rise to the top is not easy but anyone can…